jonniepaschke

About jonniepaschke

Understanding Gold IRA Investing: A Comprehensive Information

In recent years, gold has emerged as a well-liked investment possibility, notably for these looking to diversify their retirement portfolios. Gold Individual Retirement Accounts (IRAs) permit traders to hold bodily gold and different treasured metals in a tax-advantaged account. This text explores the basics of gold IRA investing, together with its benefits, the varieties of metals that can be included, the strategy of setting up an account, and key considerations for traders.

What’s a Gold IRA?

A Gold IRA is a specialised kind of self-directed Particular person Retirement Account that permits the investment of bodily gold and different valuable metals. Not like traditional IRAs, which usually hold stocks, bonds, or mutual funds, a Gold IRA allows buyers to include tangible property like gold bullion, silver, platinum, and palladium. The sort of account is designed to offer a hedge in opposition to inflation and financial instability, making it a lovely option for lengthy-term investors.

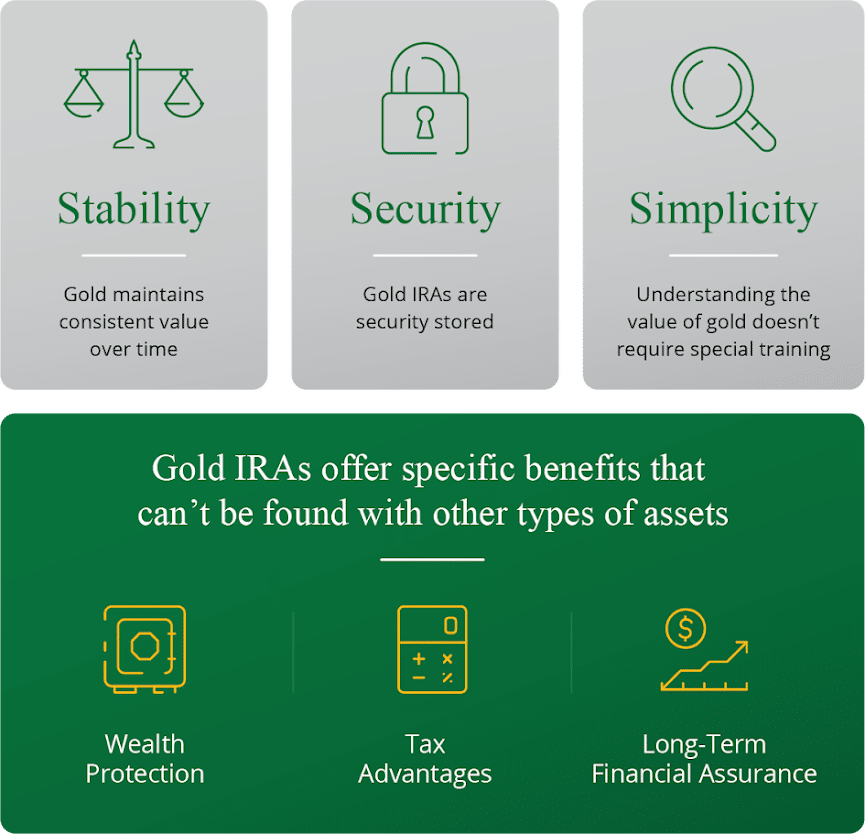

Benefits of Investing in a Gold IRA

- Hedge In opposition to Inflation: Gold has historically maintained its value throughout occasions of economic uncertainty. As fiat currencies lose buying energy as a consequence of inflation, gold usually appreciates, making it a reliable store of worth.

- Diversification: Including gold in your retirement portfolio may help diversify your investments. A nicely-diversified portfolio can scale back threat and volatility, as gold typically behaves in a different way than stocks and bonds.

- Tax Advantages: Gold IRAs provide the identical tax advantages as conventional IRAs. Contributions could also be tax-deductible, and the investment grows tax-deferred till withdrawal. Relying on the type of IRA, you might also be capable of withdraw funds tax-free in retirement.

- Safety Towards Economic Downturns: Gold is considered a ”safe haven” asset. Throughout financial downturns or geopolitical crises, investors often flock to gold, driving its worth up. This can provide a stage of safety for your retirement savings.

- Tangible Asset: In contrast to stocks or bonds, gold is a physical asset that you may hold and store. This tangible nature can supply peace of mind to traders who’re cautious of digital or paper property.

Types of Valuable Metals Allowed in a Gold IRA

When investing in a Gold IRA, you may usually embody the following forms of metals:

- Gold Bullion: Should meet a minimal purity of 99.5% to be eligible for a Gold IRA.

- Silver Bullion: Should meet a minimum purity of 99.9%.

- Platinum and Palladium: Also should meet specific purity requirements, often 99.95% for platinum and 99.9% for palladium.

It is vital to notice that collectibles, similar to rare coins or jewellery, aren’t permitted in a Gold IRA.

Find out how to Set up a Gold IRA

Organising a Gold IRA includes several steps:

- Choose a Custodian: A Gold IRA must be held by an IRS-authorised custodian. Research and choose a good custodian that makes a speciality of precious metals IRAs. Look for one with a strong track record, transparent charges, and glorious customer support.

- Open the Account: As soon as you have chosen a custodian, you possibly can open your Gold IRA account. This process sometimes entails filling out an application and providing essential documentation for identity verification.

- Fund the Account: You may fund your Gold IRA by various methods, including transferring funds from an existing retirement account (like a 401(okay) or conventional IRA), making a direct contribution, or rolling over funds from another IRA.

- Choose Your Metals: After funding your account, you’ll be able to work together with your custodian to pick the precise gold and other valuable metals you would like to buy. Be sure that the metals you choose meet IRS purity necessities.

- Storage: The bodily metals have to be stored in an accepted depository. Your custodian will typically arrange for secure storage in a facility that meets IRS regulations. You cannot store the metals at dwelling or in a private protected.

Key Issues for Gold IRA Investors

Whereas investing in a Gold IRA can be helpful, there are several considerations to bear in mind:

- Fees: Gold IRAs typically come with higher fees than traditional IRAs. If you loved this informative article and you wish to receive much more information with regards to leading ira companies for precious metals kindly visit our site. These might embody setup charges, annual upkeep charges, storage charges, and transaction fees. Make certain to understand the price construction before committing.

- Market Volatility: While gold is often seen as a stable investment, it is still topic to market fluctuations. Prices can differ considerably based mostly on economic circumstances, demand, and geopolitical occasions.

- Liquidity: Promoting physical gold can take time and should incur further costs. Not like stocks, which will be offered shortly on the alternate, promoting gold requires finding a purchaser and will involve transport and insurance costs.

- Regulatory Compliance: Make sure that your Gold IRA complies with IRS laws. Working with a reputable custodian can allow you to navigate the complexities of compliance and reporting.

- Long-Term Funding: Gold must be viewed as a protracted-term funding. While it might probably provide protection towards brief-term market volatility, it might not yield the identical returns as different investments in the quick time period.

Conclusion

Gold IRA investing generally is a useful addition to your retirement portfolio, providing a hedge in opposition to inflation, diversification, and the potential for long-time period growth. Nevertheless, it is important to conduct thorough research and consider the associated prices and dangers. By understanding the basics of Gold IRAs and working with a good custodian, you may make knowledgeable selections that align along with your monetary targets and retirement plans. As with any funding, consulting with a financial advisor is really useful to make sure that a Gold IRA fits your overall investment technique and risk tolerance.

In summary, a Gold IRA can provide a novel alternative for investors looking to secure their financial future through tangible assets. By taking the time to teach your self and make informed choices, you possibly can navigate the world of gold investing with confidence.

No listing found.